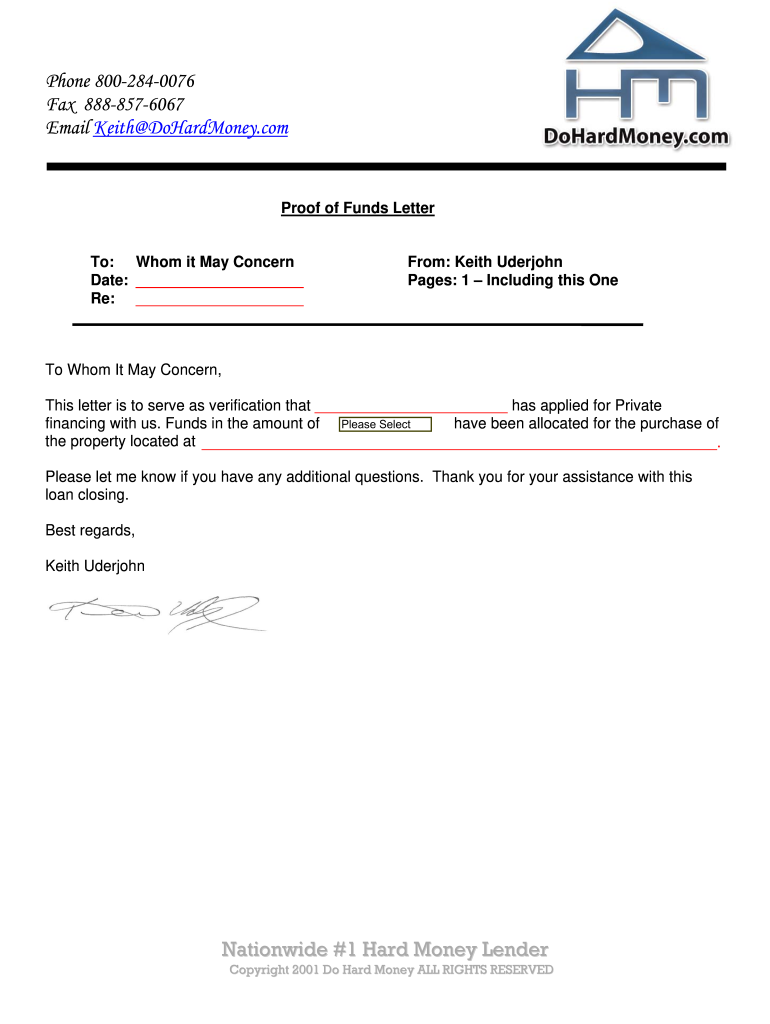

DHM Proof of Funds Letters Hard Money Lenders Form

What is the Jerry Norton Proof of Funds Letter?

The Jerry Norton proof of funds letter is a document that verifies an individual's or entity's financial capability to complete a real estate transaction. This letter is commonly required by sellers or real estate agents to ensure that potential buyers have the necessary funds available to follow through with a purchase. It typically includes details such as the amount of funds available, the source of these funds, and the contact information of the financial institution providing the verification.

How to Obtain the Jerry Norton Proof of Funds Letter

To obtain a Jerry Norton proof of funds letter, individuals can follow several steps. First, contact a bank or financial institution where you hold an account. Request a letter that states your available funds and includes pertinent details such as your account type and balance. Some institutions may require you to provide identification or complete a request form. Additionally, there are online services that can generate proof of funds letters for a fee, which may be a quicker option for some users.

Key Elements of the Jerry Norton Proof of Funds Letter

A well-structured Jerry Norton proof of funds letter should contain several key elements to ensure its effectiveness. These include:

- Account Holder Information: The name and address of the individual or entity requesting the letter.

- Financial Institution Details: The name, address, and contact information of the bank or financial institution.

- Account Information: The type of account and the current balance available.

- Statement of Funds: A clear statement confirming that the account holder has sufficient funds to complete the intended transaction.

- Date and Signature: The date of issuance and a signature from an authorized bank representative.

Steps to Complete the Jerry Norton Proof of Funds Letter

Completing the Jerry Norton proof of funds letter involves several straightforward steps. Begin by gathering your financial information, including bank statements and account details. Next, contact your bank to request the letter, providing them with any necessary information they may need. Once you receive the letter, review it for accuracy, ensuring all details are correct. Finally, present the letter to the seller or agent as part of your offer package to demonstrate your financial readiness.

Legal Use of the Jerry Norton Proof of Funds Letter

The Jerry Norton proof of funds letter is legally recognized as a valid document in real estate transactions, provided it meets certain criteria. It should accurately reflect the account holder's financial status and be issued by a reputable financial institution. This letter serves as a form of verification that can protect all parties involved in the transaction by ensuring that the buyer has the necessary funds to complete the purchase. It is essential to keep this document updated, especially if there are changes in your financial situation.

Examples of Using the Jerry Norton Proof of Funds Letter

There are various scenarios where the Jerry Norton proof of funds letter can be utilized effectively. For instance, when making an offer on a property, presenting this letter can strengthen your position as a serious buyer. Additionally, in competitive markets, having a proof of funds letter can differentiate you from other potential buyers, as it demonstrates your ability to close the deal without financial delays. It can also be required when applying for certain types of loans or financing options related to real estate investments.

Quick guide on how to complete dhm proof of funds letters hard money lenders

Effortlessly Prepare DHM Proof Of Funds Letters Hard Money Lenders on Any Device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, enabling you to easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any holdups. Manage DHM Proof Of Funds Letters Hard Money Lenders on any device using the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

Change and Electronically Sign DHM Proof Of Funds Letters Hard Money Lenders with Ease

- Find DHM Proof Of Funds Letters Hard Money Lenders and then click Get Form to initiate the process.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or mislaid files, time-consuming document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign DHM Proof Of Funds Letters Hard Money Lenders while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get a hard money lender to fund 100% of the deal, because I have literally no money, but it's a great deal?

If your great deal is tangible, and is a great deal based on its value alone, then you should be able to borrow the money provided however you have decent credit. What is a great deal or decent credit? A GOOD deal is where the monetary value exceeds your loan amount by more than 20% giving it a loan to value (LTV) ratio of less than 80%. A GREAT deal has an LTV under 50%. Decent credit means that you do not have any unpaid collections, 60 day late payments, unpaid repossessions, any foreclosures or bankruptcies on your credit reports and your scores should be at least 640. You will find a lender or an investor if you work hard. If you do not have these minimums, you will need to be creative. Maybe you could get with the person selling your great deal and see if they will rent it to you with an option to buy, the first right of refusal, and 90 days rent free. It may seem absurd to them to rent this deal if it is not real estate or equipment but you can explain to them that you believe that you can sell it better than them and are willing to put your money where your mouth is. You will have to figure out how to come up with the money for a deposit. If they are willing to do this, you should do whatever it takes to come up with that little deposit whether it is selling your personal items, blood, semen, eggs, work doubles, etc. Or maybe you can find someone else who has financial credentials that you can share this great deal with and split the profits or get paid a finders fee. Get your creative juices flowing in. There can be many, many different ways to skin this cat. Research and evaluate and ask people questions and for help. You can get something more valuable out of this experience by missing out on it - knowledge, mentors and connections. Good Luck!

-

Social Security is funded by money taken out of every paycheck for American's in the form of Federal withholding. So how can Mitch McConnell say Social Security is to expensive and needs to be cut when the government doesn't fund it the people do?

Social security benefits are funded both by payroll tax deductions and by the the Social Security Trust fund. When more money comes in through taxes than is paid out in benefits, the Fund grows. The Trust Fund (the combined OASDI Trust Funds total reserve is $2.89 trillion at the end of the year 2017) is invested in US Government securities that pay interest, a lot of interest. Social Security ran a surplus of $35 billion in 2017 and projects a surplus of $44 billion this year, 2018; however, long term projections based on the number of workers and the number of people signNowing retirement age, are that the surplus will turn to a deficit, relatively soon.If this drain went unchecked, eventually the Trust Fund would go to zero and there wouldn’t be enough money to pay social security benefits. SSA currently projects that depletion of the fund will occur in 2034.[1]Several small adjustments can be made now to fix the problem, such as raising the ceiling on income that is taxable, increasing the tax rate, lowering the social security cost of living adjustments, and raising the retirement age.The important thing in this discussion is that today the fix is easy because the Trust Fund is huge and earns lots of interest. If the Fund is starts to be depleted, that interest goes away and the amount of money to make up is vastly greater.Footnotes[1] Summary: Actuarial Status of the Social Security Trust Funds

Create this form in 5 minutes!

How to create an eSignature for the dhm proof of funds letters hard money lenders

How to create an eSignature for your Dhm Proof Of Funds Letters Hard Money Lenders online

How to generate an eSignature for your Dhm Proof Of Funds Letters Hard Money Lenders in Chrome

How to generate an eSignature for signing the Dhm Proof Of Funds Letters Hard Money Lenders in Gmail

How to make an eSignature for the Dhm Proof Of Funds Letters Hard Money Lenders from your mobile device

How to create an electronic signature for the Dhm Proof Of Funds Letters Hard Money Lenders on iOS

How to make an electronic signature for the Dhm Proof Of Funds Letters Hard Money Lenders on Android devices

People also ask

-

What is dohardmoney proof of funds?

Dohardmoney proof of funds is a financial document that shows you have sufficient funds available to complete a real estate transaction. It’s a crucial tool for investors to demonstrate their purchasing capability. With airSlate SignNow, you can easily create and send dohardmoney proof of funds documents promptly.

-

How does airSlate SignNow help with dohardmoney proof of funds?

airSlate SignNow simplifies the process of creating and sending dohardmoney proof of funds. Our platform allows you to customize your documents, add eSignatures, and ensure everything is done securely and efficiently. This helps you close deals faster and with ease.

-

Is there a cost associated with using airSlate SignNow for dohardmoney proof of funds?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The plans are cost-effective, ensuring you get value when creating dohardmoney proof of funds and other documents. You can choose a plan based on your usage and feature requirements.

-

Can I integrate airSlate SignNow with other platforms for dohardmoney proof of funds?

Absolutely! airSlate SignNow provides integrations with various third-party applications, making it easier to manage your dohardmoney proof of funds and other documents. You can connect it with CRMs, cloud storage, and more to streamline your workflow.

-

What features does airSlate SignNow offer for creating dohardmoney proof of funds?

airSlate SignNow includes features such as customizable templates, eSigning, document tracking, and secure cloud storage. These features enhance the efficiency of producing dohardmoney proof of funds and ensure that you have full control over your documents at all times.

-

How long does it take to create a dohardmoney proof of funds with airSlate SignNow?

Creating a dohardmoney proof of funds with airSlate SignNow is quick and efficient. You can generate the document within minutes, thanks to our user-friendly interface and pre-designed templates. This allows you to focus on closing deals rather than getting bogged down in paperwork.

-

Is airSlate SignNow secure for handling dohardmoney proof of funds?

Yes, airSlate SignNow prioritizes the security of your documents, including dohardmoney proof of funds. We use advanced encryption protocols and robust security measures to protect your sensitive information, ensuring that your documents are safely stored and transferred.

Get more for DHM Proof Of Funds Letters Hard Money Lenders

- Wisconsin international fuel tax agreement form

- Influenza vaccination declination form influenza is a

- Housing registry bc form

- Certificate of service federal court sample form

- Erasmus application form

- Express scripts appeal form norwalk

- New york state smoke detector affidavit form

- Graphic design work for hire agreement template form

Find out other DHM Proof Of Funds Letters Hard Money Lenders

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU